Technological Analysis

Coined as the “Ethereum killer” Binance Smart Chain (BSC) launched in Sep 2020 positioning itself to capitalise on the shortfalls of the Ethereum platform. Offering low transaction fees, scalability and EVM compatibility (enables projects to copy and paste their Ethereum DAPP code straight onto the BSC chain).

BSC can handle up to 300 TPS according to Binance CEO with transactions costs currently at $0.15/transaction. BSC has been a no brainer for a multitude of DAPPs frustrated by the state of the Ethereum ecosystem which explains why it has amassed such a large following in such a short amount of time, especially given the fact that the crypto ecosystem has grown exponentially during 2021 which has caused huge bottlenecks in the Ethereum network leading gas fees (transaction fees) to skyrocket.

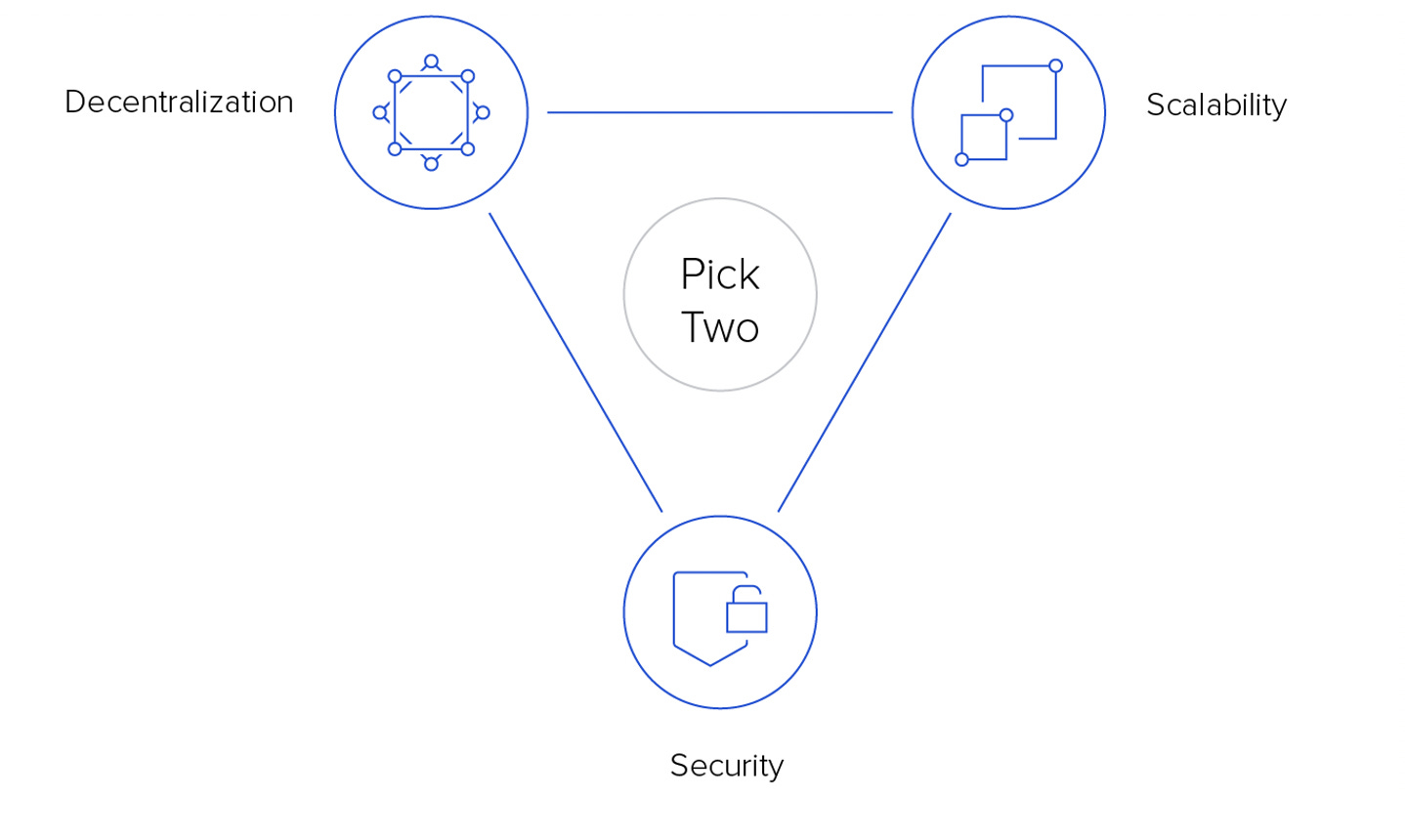

For all the great things going for BSC, it does not come without its drawbacks. BSC is a prime victim and example of the famous Blockchain Trilemma.

By focusing its efforts on the Scalability and the Security side of the triangle it foregoes Decentralisation. The BSC blockchain utilises a PoSA consensus model, a variant of PoS where a select group of validators/nodes are elected. In BSC there are currently only 21 nodes validating transactions on the network. In comparison bitcoin has over 10,000 nodes while Ethereum has 3,500 at the time of writing.

By centralising validators, BSC increases the vulnerability to attacks as validators are significantly more concentrated within one central point; there are currently only 21 nodes in BSC.

Additionally, there are fears of censorship as BSC is controlled by the Binance organisation, albeit they have not made any moves in this direction so far. However, it is important to consider the current situation with the Binance organisation as whole. Currently the organisation is under significant regulatory scrutiny from a number of governments across the world. Eventually this could lead to regulation and censorship of the BSC chain itself, due to its centralised design. Most blockchains on the other hand are immune to this eventuality by making decentralisation a clear priority from day one.

Overall, It is clear that Binance Smart Chain has successfully solved many of issues which plague the Ethereum network. It’s technological edge however, is not so significant when compared to it’s competition (outside of Ethereum); 300 TPS is quite small in comparison. When combined with its lack of decentralisation, it is hard to see Binance Smart Chain being a platform of choice for the many projects of the future.

Market Adoption Evaluation

Whilst technologically speaking Binance Smart Chain does not have anything exceedingly special going for it, adoption wise it has been making a killing. Being at the right place and right time in combination with the power of EVM compatibility, it has managed to be a huge leach on the Ethereum network.

Released in September 2020, BSC has attracted $1.2B in total transaction volume after just one month. By January 2021 BSC had over 100 individual DAPPs on its platform. Today BSC boasts a lofty 825 projects on its platform with a monthly growth rate of 13% (110 new projects/month) albeit the growth rate is on a downwards trend. This is almost 10X the number of new projects appearing on Ethereum every month.

The number of developers who could use BSC is the same as Ethereum due to EVM compatibility. By analysing GitHub we can gauge a good approximation of how many developers are using the platform as we speak. BSC has around 548 stars on Github and 8,000 discord members, worst in class statistics, which suggests that although the ecosystem is rather large there is not so much active development work on a regular basis, unlike the Ethereum network and its other competitors which have smaller project ecosystems.

Outside the development community statistics display rather positive trends. BSC has over 750,000 followers on twitter and over 500,000 on reddit, with respective monthly growth rates (averaged over 6 months) of 38% (twitter) and 35% (reddit). BSC has the second largest community which is not far behind Ethereum and increasing in size at a much faster rate.

Price wise, the Market Cap of BNB (BSC’s native token) has historically been very healthy, clocking in at $72B, BNB has the 4th highest valuation by market cap, only recently dropping behind Cardano. Although almost 6x in size behind Ethereum it never the less displays a strong showing. Its average monthly growth rate in market cap is 64% (over 12 months), almost double Ethereum’s. However, this statistic may be interpreted as being slightly skewed and misleading due to BSC only launching a year ago with its growth only stabilising more recently, whilst Ethereum has been around for 8 years.

In terms of funding the whole Binance organisation including the exchange has received over $35M in backing across various investors and funding rounds. The developer team controls around 40% of the total BNB supply with an unknown amount dedicated to the support of the BSC ecosystem.

Additionally, Binance Smart Chain runs a $100M accelerator fund to support the adoption of new projects on its ecosystem. When looking at BSC from a perspective of intuitional support and endorsement, things look kind of bleak.

Firstly BSC sacrifices decentralisation through its consensus model, meaning there is an existential risk of censorship for any institution when deciding to build applications on the platform.

Second of all the Binance organisation as a whole is getting a lot of heat across various governments increasing their regulatory scrutiny on its operations. From this we can draw that there is a lack of trust towards Binance from institutions, which does not do BSC any favours when coupled with its centralised consensus mechanism.

I do not for-see Institutions from any sectors building applications on BSC in the future for the issues I mentioned.

On the other hand, the DeFi (Decentralised Finance) community of BSC is healthy, with avg. Total Value Locked (TVL) at $17 Billion over 3 months, in comparison to Ethereum’s $84 Billion.

Additionally daily transaction volume across all Dapps on the BSC ecosystem is $2.85 Billion at the time of writing compared to Ethereum’s $4.67 Billion which is surprising given how much larger the market of the Ethereum platform is, suggesting that the market regards Ethereum as a more suitable vehicle for investment whilst BSC is a better product for average daily users. This statement is confirmed further when looking at the number of users on BSC which has an average of 550,000/day which is five times greater than the Ethereum platform. This is a best-in-class statistic across all Blockchains. One negative point to consider is that BSC has been a victim to many rug-pulls on its ecosystem (a rug pool is a Ponzi scheme), however this will likely only be a short-term issue.

Overall Binance Smart Chain is a very competitive platform when analysing its ecosystem and user adoption.

Token Economics Analysis:

The native token of Binance Smart Chain is BNB. BNB is used across the whole Binance ecosystem. Although BNB is used on the BSC blockchain, its main use is on the Binance exchange.

Binance incentivises users to make trading swaps utilising BNB by offering lower transaction and trading fees. BNB can therefore be categorised as a discount token.

BNB is also used to pay transaction fees on the Binance Smart Chain ecosystem. Validators are only rewarded with transaction fees, meaning no new coins are minted, having no effect on the total supply.

The current supply of BNB is 168 million. When BNB was launched it had a market cap of 200 million, meaning BNB’s supply has dropped by 32 million since launch. BNB is a deflationary token. This because the Binance organisation has made a repurchasing pledge.

Every quarter Binance reinvests 20% of its profits to buy back BNB and destroy it (burn). This creates long term buy pressure on BNB, enjoyed by all its long-term holders. To avoid short term volatility, Binance does not purchase new BNB from the market, but just burns the existing BNB it has earned as revenue from trading on its exchange platform. Binance plans to continue the repurchasing strategy until a total supply of 100 million for BNB has been reached.

Therefore we can make a deduction, that investing in BNB is more of a question of investing in Binance as a company based on its current revenues and future cash flows.

Binance Smart Chain and its utility should be looked upon as secondary to Binance’s main source of operations. In Q1 of 2021 Binance burned a total of $600 Million worth of BNB, suggesting $3B profit within 3 months (its largest burn event in history).

Binance’s Q2 burn was valued at $390 Million meaning close to $2B in profit. Binance’s Q3 burn event will be occurring over the next couple weeks. By looking at Q1 and Q2 figures, we can clearly see Binance has had a terrific 6-month streak making almost $5 billion in profit. However, most regulatory intervention has occurred after Q2 this year. It will be interesting to see how this has affected their total profits in combination with the recent Chinese crackdown on crypto operations.

BNB’s token distribution is as follows: 50% ICO, 40% Team and 10% for angel investors. Analysing this we can clearly see that the distribution is weighted heavily towards its founding team compared to its competition. Since Binance functions as more of cooperation rather than a decentralised business, this sort of token distribution makes sense and is acceptable as it is similar to publicly listed shares.

Conclusions:

Technological Analysis:

BSC has a mediocre 300 Transactions Per Second

BSC has very poor decentralisation with only 21 nodes

BSC has an existential risk of censorship

BSC has EVM compatibility making it a desirable platform for DAPPs built on Ethereum

BSC does not have native interoperability with other blockchains

Score: 3/10

Market Adoption:

BSC has second best in class adoption

BSC gets to leverage all the stellar developer tools built for Ethereum via EVM

BSC has the second largest ecosystem of projects: 825

BSC has a large market cap of $72B

BSC has low level of institutional support

Binance is under significant regulatory scrutiny

Binance has the second largest DeFi ecosystem: $17B Total Value Locked (TVL)

Binance has the highest active daily users 550,000

Score: 8/10

Token Economics Analysis:

BNB has excellent utility on the Binance Exchange

BNB is a deflationary asset

Binance invests 20% of its profits in repurchasing and destroying BNB

Success of BNB depends on profitability of the whole Binance organisation

Binance has repurchased almost $1B in BNB during 2021

Future of Binance organisation is uncertain

Token distribution is heavily weighted towards team

Score: 7/10

Total: 18/30

In summary, investing in BNB is effectively investing in Binance. The token economics make investing in BNB very favourable in the long term as long as Binance continues to grow its operations as an exchange. The success of Binance Smart Chain is ancillary to the success of Binance’s exchange which provides most of the utility and value to BNB.

Even if Binance Smart Chain grows as a platform, irrelevant of its technological inferiority to its competition, it is unlikely to significantly impact the value of BNB as most its revenue is generated via the exchange.

Binance is a hugely successful organisation and will likely enjoy significant growth over the next few years as the crypto industry becomes more mainstream, but there is an undeniably large risk due to regulatory scrutiny, which could really hurt its future success. As centralised exchanges go there are far more reputable and institutionally supported organisations to invest in such as Coinbase or Gemini.

Interesting report and good to see the detail it has gone into. However, its equally interesting to see Token Economics being defined in terms of revenue in your analysis. Token Design the alignment of incentives within the design has a bearing too on the quality of the token.